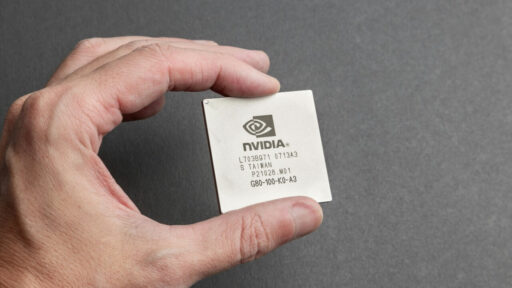

Nvidia has introduced a new policy requiring full upfront payments for its H200 AI chips sold in China, replacing earlier arrangements that allowed buyers to settle part of the bill after delivery. People familiar with the change say the prepayment rule is already triggering a liquidity shock across China’s AI sector as companies race to secure cash or credit lines. The shift comes as U.S. export restrictions on advanced semiconductors tighten, amplifying financial pressure on Chinese technology firms that depend on high‑end GPUs for training large AI models.

Policy Shift Details

Industry sources describe Nvidia’s new requirement that Chinese customers pay the entire invoice for H200 GPU orders before shipment as a clear break with past practice. According to reporting on the Nvidia H200 China prepayment rule, distributors and end users have been told that partial deposits are no longer sufficient and that full settlement is now a condition for allocation of scarce H200 supply. I see this as a move that effectively shifts inventory and financing risk away from Nvidia and onto Chinese buyers at a time when demand for advanced accelerators far exceeds available volumes.

Previously, Chinese customers buying comparable Nvidia GPUs could rely on staggered payment structures that combined deposits, shipment-linked installments, and short credit terms from local partners. Reporting on the Nvidia H200 China prepayment policy notes that some data center operators had negotiated schedules that aligned payments with the rollout of AI services, which helped them match cash outflows to expected revenue. By imposing immediate, complete settlement on ongoing and future H200 transactions, Nvidia has upended those assumptions, forcing buyers to front-load capital for hardware that may not generate returns for months.

Immediate Stakeholder Reactions

Chinese AI companies are already confronting sudden cash flow stress as they adapt to the Nvidia H200 China prepayment rule. Sources cited in coverage of the full upfront payment demand say several model developers that had planned to scale clusters with H200 units are now revisiting budgets, delaying orders, or seeking bridge financing from state-backed funds. I interpret these reactions as evidence that even well-funded players underestimated how quickly payment terms could tighten once export controls and supply scarcity converged.

Major data center operators in China, including hyperscale cloud providers that host training workloads for multiple clients, are reported to be adjusting procurement strategies in response to the new requirement. According to people briefed on the matter, some operators are prioritizing H200 allocations for their highest-margin AI services while pushing smaller customers toward less advanced GPUs or shared capacity. Nvidia executives and spokespeople, as described in the same reporting, have framed the full upfront payment requirement as a commercially necessary step to manage risk and ensure that limited H200 inventory is committed only to buyers with firm financial backing, a rationale that underscores how payment policy has become a tool for rationing access.

Liquidity Shock in AI Ecosystem

The shift to complete prepayment is reverberating across China’s AI ecosystem as a liquidity shock that goes beyond individual balance sheets. Reporting on the Nvidia H200 China prepayment rule explains that startups building large language models and recommendation engines now face a steeper hurdle to secure the GPUs they need, because venture capital and bank financing must cover the entire hardware bill upfront rather than being spread over deployment milestones. I see this as a structural tightening that could slow the pace of experimentation, since smaller teams may be forced to rent capacity from larger platforms instead of owning their own clusters.

Specific AI training projects are already being delayed or resized as funding gaps emerge for high-end GPU acquisitions tied to H200 orders. Sources cited in the coverage describe cases where planned multi-thousand GPU clusters have been cut back or postponed while sponsors renegotiate credit terms or seek additional equity. These delays ripple through supply chain partners, including distributors that had extended informal credit to favored customers, who are now facing closer scrutiny from their own lenders and may respond by shortening payment windows for downstream buyers, a dynamic that tightens liquidity at every layer of the AI hardware stack.

Geopolitical and Market Context

Analysts link Nvidia’s stricter payment stance directly to the backdrop of U.S. export controls on advanced semiconductors destined for China. The reporting on full upfront payment for H200 chips notes that Nvidia is navigating a regulatory environment in which product specifications, shipment approvals, and customer eligibility can change quickly, creating legal and financial uncertainty around any inventory held for Chinese buyers. In my view, requiring prepayment helps the company reduce exposure to sudden rule changes that could otherwise leave it with unsellable stock or unpaid receivables tied to restricted customers.

Market observers also see potential long-term shifts in global AI hardware demand as Chinese firms respond to liquidity pressures by exploring alternative suppliers and architectures. The same sources say some Chinese companies are accelerating efforts to qualify domestic accelerators, re-optimizing software stacks to run on non-Nvidia hardware, or turning to cloud-based access models that spread costs over time instead of concentrating them in a single prepayment. Analysts are closely monitoring how this policy change affects Nvidia’s revenue mix from the Chinese market, since a near-term boost in cash collections from prepaid H200 orders could be offset over time if customers diversify away from Nvidia to reduce both geopolitical and financing risk.