The Google Chief has issued a stark warning on the trillion-dollar AI investment boom, describing it as having “elements of irrationality” during a recent address that underscores growing concerns in the tech sector. The remarks, delivered on November 18, 2025, come as unprecedented capital inflows push AI valuations higher without proportional returns, raising fresh questions about how sustainable the current wave of enthusiasm really is.

As I look at the scale and speed of this boom, the shift in tone from earlier optimism voiced by industry leaders signals a more cautious phase for investors and companies alike, with potential volatility ahead if expectations fail to match what AI technologies can realistically deliver in the near term.

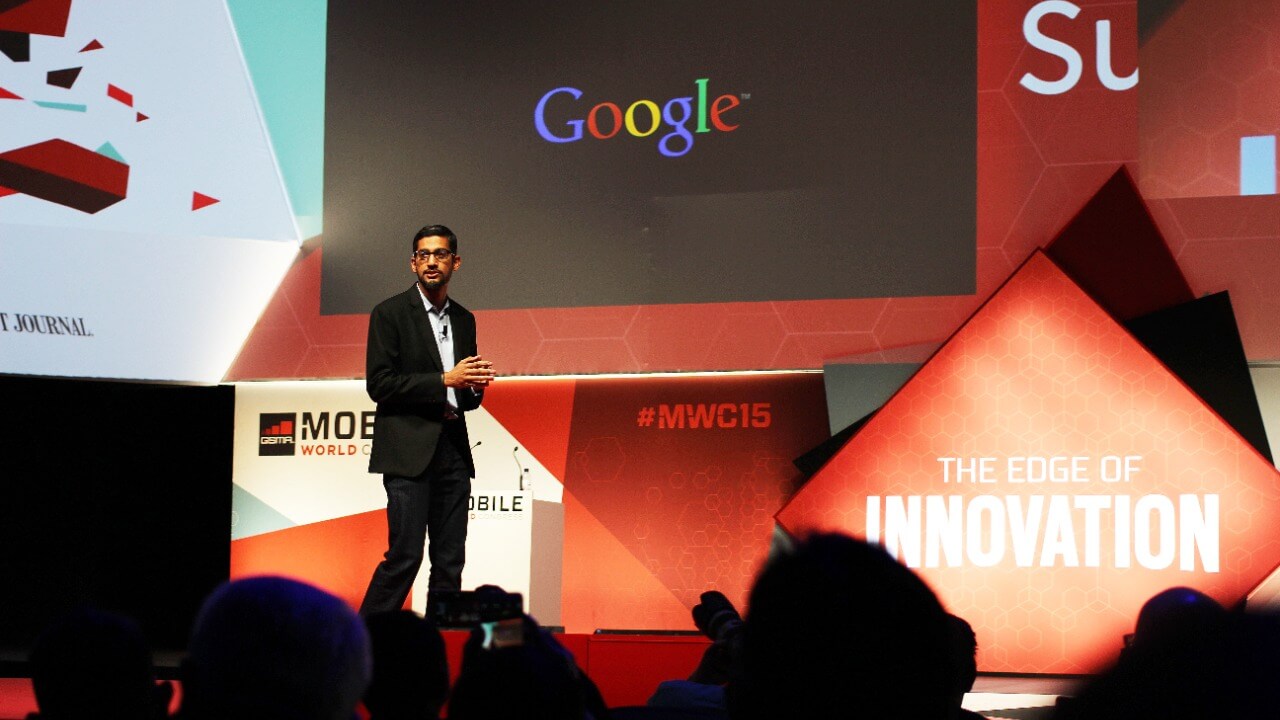

Google’s Leadership Weighs In on AI Hype

In the address, the Google Chief explicitly described the trillion-dollar AI investment boom as having “elements of irrationality,” a phrase that, according to a detailed report on the trillion-dollar AI investment boom, was chosen to signal concern rather than outright alarm. By framing the surge in AI funding in those terms, the executive acknowledged that while AI remains a core strategic priority, parts of the market appear to be driven more by fear of missing out than by clear evidence of sustainable business models. For stakeholders who have treated AI as a one-way bet, that language marks a notable departure from the unqualified enthusiasm that dominated boardrooms and investor calls only a year or two ago.

From my perspective, the warning also reflects a tension inside Google itself, which has poured vast sums into generative models, custom chips, and cloud infrastructure even as it faces mounting pressure to show profits from those bets. The company’s leadership is effectively admitting that the cost of staying at the frontier of AI development is rising faster than many of the near-term revenue opportunities, a dynamic that can strain margins and invite shareholder scrutiny. By calling out “elements of irrationality” in the broader market, the Google Chief is not only cautioning rivals and investors, but also setting expectations that even a tech giant with deep pockets must be more selective about which AI projects it backs and how quickly it expects them to pay off.

Rising Investments Fuel Irrational Elements

Across the industry, the scale of the trillion-dollar AI investment boom has been defined by aggressive venture capital flows into generative AI startups and the infrastructure that supports them, from data centers to specialized chips. Aggregated funding figures from 2024 to 2025 show capital piling into companies that promise everything from AI copilots for software developers to automated drug discovery, often at valuations that assume rapid, global adoption. I see that pattern reflected in the way investors have treated AI as a catch-all solution, rewarding firms that can attach “AI-powered” to their pitch decks even when their products remain early-stage or unproven in real-world settings.

Examples of overhyped projects are increasingly visible, with some firms securing multibillion-dollar valuations before they have meaningful revenue, a trend that the same report on the AI investment boom links directly to the “elements of irrationality” cited by the Google Chief. In prior years, AI funding grew roughly 50% year over year, but investors could still point to clear productivity gains in areas like recommendation systems, targeted advertising, and cloud-based machine learning services. Now, as capital commitments swell toward the trillion-dollar mark, returns on that incremental investment appear to be diminishing, which raises the stakes for pension funds, sovereign wealth funds, and retail investors whose money is ultimately fueling the boom.

Implications for Tech Stakeholders

For major players like Google, the warning about irrationality in AI markets forces a delicate balancing act between innovation and risk management. The company must continue to invest in frontier models and infrastructure to remain competitive, yet it also faces growing regulatory scrutiny over how those systems are trained, deployed, and monetized. When the Google Chief highlights irrational elements in the boom, I read it as an attempt to reassure policymakers that the company is aware of the systemic risks that come with concentrated, trillion-dollar bets on a single technology trend, and that it is prepared to support guardrails that keep the market from overheating further.

Smaller AI firms that rely heavily on venture funding are likely to feel the effects of this shift in tone even more acutely, because their survival often depends on repeated funding rounds at ever-higher valuations. The trillion-dollar scale of the current boom amplifies fears of a bubble reminiscent of past tech cycles, where easy money flowed into dot-com startups or crypto projects before abruptly drying up. As I see it, the Google Chief’s comments could accelerate a pivot among investors from chasing growth at any price to demanding clearer paths to profitability, which would slow deal flow compared with the unchecked growth that characterized early 2025 and force founders to justify their valuations with concrete metrics rather than aspirational narratives.

Broader Market and Regulatory Shifts

The remarks about “elements of irrationality” are likely to reverberate beyond Silicon Valley, influencing how global regulators and policymakers think about AI as a systemic financial and technological risk. When a company of Google’s scale signals that parts of the AI market may be overheating, it gives cover to officials who have been pushing for more oversight of large-scale AI investments, including stress tests for financial institutions with heavy exposure to AI-focused funds. I expect those comments to feed into debates over whether AI infrastructure should be treated as critical national infrastructure, subject to stricter reporting requirements and capital adequacy standards that could slow the pace of speculative investment.

On Wall Street and in other financial centers, the shift in tone from hype to caution is already prompting analysts to revisit their models for AI-related earnings and valuations. Investors who once treated AI as an unqualified economic boon in 2023 and 2024 are now more likely to differentiate between companies with proven AI revenue streams and those that are still in the experimental phase. By drawing a clear line between rational long-term investment and speculative excess, the Google Chief’s warning may encourage portfolio managers to rebalance away from the most richly valued AI names and toward firms that can demonstrate durable cash flows, potentially reshaping capital allocation strategies for years to come.