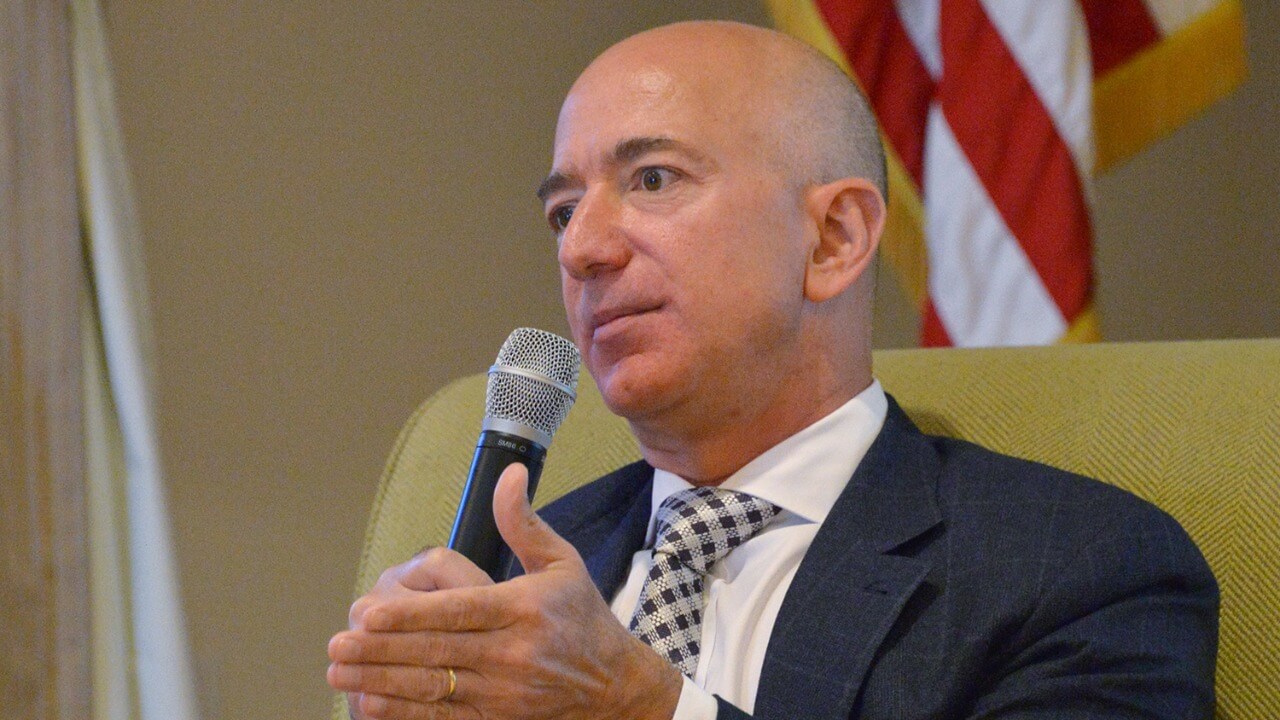

Jeff Bezos is moving to put his stamp on the satellite internet race, unveiling a new orbital network that aims to match, and in some ways surpass, today’s largest constellations. The project, built around a high‑capacity architecture and thousands of spacecraft, is designed to serve data‑hungry businesses rather than home users, signaling a strategic pivot in how space broadband is being carved up.

The blueprint, centered on a system called TeraWave, positions Bezos and Blue Origin to compete directly with existing players while targeting a different slice of the market. Instead of chasing residential subscribers, the plan focuses on enterprise, government, and cloud customers that need resilient, ultra‑fast connectivity across the globe.

The TeraWave vision: 5,400 satellites and 6 Tbps links

The core of Bezos’s new play is a planned megaconstellation of roughly 5,400 satellites, a scale that would instantly place Blue Origin among the largest operators in orbit. Reporting on the project describes a network that blends different orbital regimes, with a large fleet in medium Earth orbit and additional spacecraft in other bands to balance coverage, latency, and resilience for demanding clients, a design that aligns with the ambition to build a true global backbone rather than a consumer access network, as detailed in early coverage of 5,400 satellites.

What sets TeraWave apart on paper is raw throughput. The network is being pitched with individual links of up to 6 Tbps, a figure that would put it in a different league from most current broadband constellations and is enabled by laser‑based inter‑satellite and downlink technology in the more capable MEO spacecraft, according to technical descriptions that note that “And the MEO” segment will use optical links to reach those speeds for enterprise‑grade services, as outlined in plans for And the MEO.

Bezos, Blue Origin and the corporate chessboard

The constellation is being developed inside Blue Origin, the rocket company that Mr Bezos has been steadily repositioning from a launch startup into a full‑spectrum space infrastructure provider. In a recent briefing, the company framed TeraWave as a natural extension of its existing work on heavy‑lift rockets and lunar landers, with Mr Bezos’s space firm explicitly stating that the network will be operated by Blue Origin and will offer businesses speeds of up to 6 Tbps, a claim that underscores how the project is meant to complement its other programs, including support for NASA’s Artemis Moon missions, as described in detail by Mr Bezos.

For Jeff Bezos personally, the move deepens a long‑running effort to translate his terrestrial dominance in e‑commerce and cloud computing into orbital infrastructure. Coverage of the announcement notes that Jeff Bezos appeared alongside Blue Origi executives as part of a broader investor‑facing push that also referenced AMZN and highlighted how the project fits into the company’s wider ecosystem, with one account by Anthony Cuthbertson pointing out that the briefing ran to 2 min read and that the number 38 featured in the context of the discussion, details that underline how carefully the rollout was choreographed for markets and regulators, as seen in the description of Anthony Cuthbertson.

A direct challenge to Musk and SpaceX

Strategically, TeraWave is impossible to separate from the rivalry between Jeff Bezos and Musk, whose SpaceX has used Starlink to dominate the first wave of satellite broadband. Analysts describe the new constellation as the latest step in Bezos’s effort to build a system that can rival SpaceX’s existing network, with one assessment noting that Jeff Bezos is escalating his rivalry with the Starlink operator by planning thousands of satellites that will provide standard broadband service alongside higher‑end enterprise links, a framing that casts the project as part of a broader contest for orbital market share, as outlined in coverage of Jeff Bezos’s grand.

Blue Origin itself has been explicit that the new network is meant to compete directly with Musk’s SpaceX, with one briefing stating that Jeff Bezos’s Blue Origin announced plans to launch over 5,000 satellites as part of a system that would go head‑to‑head with Starlink on performance and coverage, a message that underscores how the company sees itself as a peer rather than a niche player in the orbital broadband market, as reflected in the description of how Jeff Bezos and Musk are now locked into a more direct confrontation over satellite internet in reports on Musk.

Enterprise first: why consumer broadband is not the main target

One of the most striking aspects of the TeraWave blueprint is what it is not trying to do. Rather than promising cheap home internet for rural households, Blue Origin is positioning the constellation as a backbone for businesses, governments, and cloud providers that need high‑capacity, symmetrical connections and redundancy across continents. Industry analysis of the plan notes that Blue Origin’s Mega Constellation Not Expected to Disrupt Consumer Broadband Competition, with experts arguing that the focus on enterprise‑grade services, higher price points, and integration with existing terrestrial networks means the system will sit alongside, rather than directly undercut, mass‑market offerings, a view captured in assessments of how the project will likely not Disrupt Consumer Broadband Competition despite its scale, as detailed in commentary on Mega Constellation Not.

Blue Origin has framed TeraWave as a response to what it calls unmet needs among customers who want higher throughput, symmetrical upload and download speeds, and more redundancy than current networks provide, particularly for applications like cloud data replication, financial trading, and real‑time industrial control. One summary of the company’s pitch notes that “TeraWave addresses the unmet needs of customers who are seeking higher throughput, symmetrical upload/download speeds, more redundancy, and the ability to deploy globally while maintaining performance,” language that makes clear the constellation is being sold as a premium infrastructure layer rather than a consumer product, as described in detail in the company’s explanation of how TeraWave addresses those gaps.

Regulatory, orbital and competitive hurdles ahead

Even with Bezos’s resources, turning TeraWave from blueprint into orbiting hardware will be a complex, multi‑year effort that plays out across launch pads, regulatory hearings, and crowded orbital shells. One analysis of the announcement notes that Another Jeff Bezos company has now joined the rush to build a megaconstellation, highlighting that the project will have to navigate spectrum coordination, debris mitigation, and competition for favorable orbital slots at a time when regulators are already grappling with the impact of thousands of active satellites, a challenge that has only grown as more firms seek to deploy globally while maintaining performance, as emphasized in technical commentary on how Another Jeff Bezos venture is entering the field.

At the same time, Bezos is not starting from scratch in the satellite arena. Earlier reporting on his broader strategy notes that Jeff Bezos has been assembling a constellation plan for years, including satellites aimed at providing standard broadband service and integration with his existing cloud and logistics businesses, a long‑term effort that is now converging with Blue Origin’s TeraWave ambitions and that signals a more coordinated push to build an end‑to‑end space and data infrastructure stack, as described in assessments of how Jeff Bezos is knitting together his various satellite projects.