Samsung Electronics has forecast that its fourth-quarter operating profit will surge by 208%, effectively tripling to a record high, as the company rides a powerful wave of demand tied to artificial intelligence in both its semiconductor and smartphone businesses. The estimate, which covers the quarter ending in December, signals a sharp turnaround from the chip slump that weighed on earnings in earlier periods and marks a decisive break from the industry’s recent downturn. The guidance also underscores how central Samsung has become to the global AI supply chain, setting expectations for continued momentum into the new year.

Forecast Details

Samsung Electronics has told investors it expects a 208% rise in fourth-quarter operating profit, projecting that earnings for the period ending in December will reach a record high level compared with the same quarter a year earlier. The company’s guidance indicates that operating profit will effectively triple from the previous quarter, highlighting how quickly conditions have improved in its core memory and logic chip businesses after a prolonged downturn. By flagging such a steep year-on-year and sequential increase at the close of the fiscal year, Samsung is signaling that the worst of the semiconductor cycle appears to be behind it and that the company is entering 2025 from a position of renewed financial strength.

The forecasted surge in operating profit is explicitly tied to Samsung’s latest guidance, which states that the 208% rise reflects a combination of higher selling prices for memory chips, stronger shipments of advanced components, and improved profitability in its smartphone division. Because the fourth quarter is typically one of the most important periods for consumer electronics demand, the record high projection for the quarter ending in December carries outsized weight for analysts assessing the company’s full-year performance and its trajectory into the next cycle. For institutional investors and suppliers that depend on Samsung’s capital spending, the guidance provides a concrete benchmark for planning production, inventory, and investment decisions around the company’s expected cash flow.

AI Boom’s Contribution

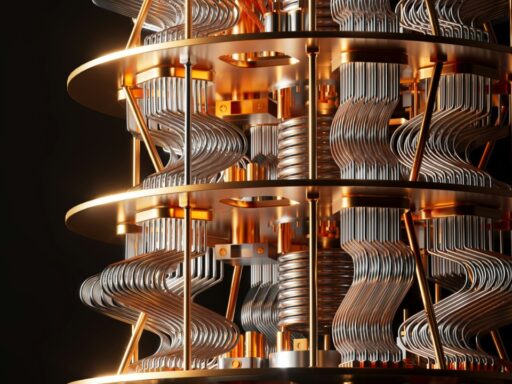

Samsung has framed the ongoing artificial intelligence boom as the primary engine behind its projected profit jump, pointing to surging demand for AI-related semiconductors and memory chips used in data centers and high-performance computing. The company’s semiconductor unit has benefited from a rapid shift toward high-bandwidth memory (HBM) chips that are tailored for AI training and inference workloads, which require far higher data throughput than conventional applications. As cloud providers and AI developers race to deploy larger models and more capable services, they are ordering more of the advanced memory products that sit at the heart of Samsung’s portfolio, directly feeding into the 208% rise in operating profit the company has forecast in its latest guidance linked to the estimated fourth-quarter profit surge.

The AI boom has also had knock-on effects across Samsung’s broader business, including its smartphone division, where devices increasingly rely on on-device AI features and specialized processors to differentiate in a crowded market. Higher demand for premium handsets that incorporate AI-enhanced cameras, translation tools, and productivity features has supported better pricing and margins, complementing the gains in the semiconductor segment. By contrast, non-AI segments such as legacy memory products and lower-end consumer electronics have seen a slower recovery, which highlights how central AI-linked demand has become to Samsung’s earnings profile. For customers and partners, this shift means that Samsung’s future product roadmap and capital allocation are likely to remain heavily skewed toward AI-enabling technologies, from HBM and advanced DRAM to system-on-chip designs optimized for machine learning.

Beating Market Expectations

The projected 208% rise in fourth-quarter operating profit does more than mark a cyclical rebound; it also exceeds the consensus expectations of analysts who had anticipated a more gradual recovery. Market forecasts had generally assumed that lingering oversupply in certain memory categories and cautious enterprise spending would cap Samsung’s near-term upside, but the company’s guidance indicates that demand for AI-related components has tightened supply faster than many models predicted. By signaling that operating profit will triple to a record high level, Samsung is effectively revising the market’s understanding of how quickly AI demand can translate into earnings, which has immediate implications for valuation models and sector-wide sentiment.

Earlier quarters told a very different story, with profits pressured by a glut of memory chips and falling prices as customers worked through excess inventories built up during the pandemic-era surge in electronics demand. Those conditions forced Samsung and its peers to cut production, delay some investments, and absorb weaker margins, which weighed on share prices and raised questions about the timing of the next upturn. The latest guidance on fourth-quarter operating profit, which points to a 208% year-on-year increase and a tripling of earnings from the previous quarter, marks a clear inflection point from that oversupply-driven slump. For shareholders, creditors, and employees, the shift signals a more supportive environment for dividends, capital expenditure, and hiring, even as global tech markets remain volatile and sensitive to shifts in interest rates and geopolitical risk.

Implications for 2025

The record high profit Samsung expects to report for the quarter ending in December sets a powerful baseline for its 2025 performance, giving the company more financial flexibility to invest in the next generation of AI hardware. With operating profit projected to triple and rise 208% year on year, Samsung is positioned to expand capacity for advanced memory nodes, accelerate development of higher-density HBM products, and push forward with cutting-edge foundry technologies that target AI accelerators and custom chips. A stronger balance sheet at the end of the fiscal year also improves the company’s ability to weather any short-term fluctuations in demand, which is particularly important in a sector where capital spending cycles are long and highly sensitive to macroeconomic conditions.

Looking ahead, I see the profit surge as a catalyst for more aggressive competition in the AI hardware market, where Samsung faces rivals that are also racing to capture share in HBM, advanced DRAM, and AI-optimized logic chips. The company’s guidance on a record fourth-quarter operating profit, tied directly to the AI boom and the tripling of earnings, suggests that it will have both the incentive and the resources to challenge competitors more forcefully on performance, power efficiency, and pricing. For cloud providers, device makers, and enterprise customers, that could translate into faster innovation cycles and a broader range of AI-capable products, but it may also intensify supply constraints in the most advanced nodes if demand continues to outpace industry-wide capacity additions. As 2025 unfolds, the sustainability of Samsung’s profit trajectory will depend on how effectively it converts this current AI-driven windfall into long-term technological and manufacturing advantages.