The AI frenzy has triggered a memory chip supply crisis, exacerbating global supply chain disruptions as demand surges for high-bandwidth memory essential for AI applications. Micron plans to invest $9.6 billion in Japan to construct a new AI memory chip plant, signaling a major push to address shortages. The rapid expansion of AI technologies is straining production capacities worldwide, with recent reports underscoring the urgency of scaling up manufacturing.

The Surge in AI-Driven Demand

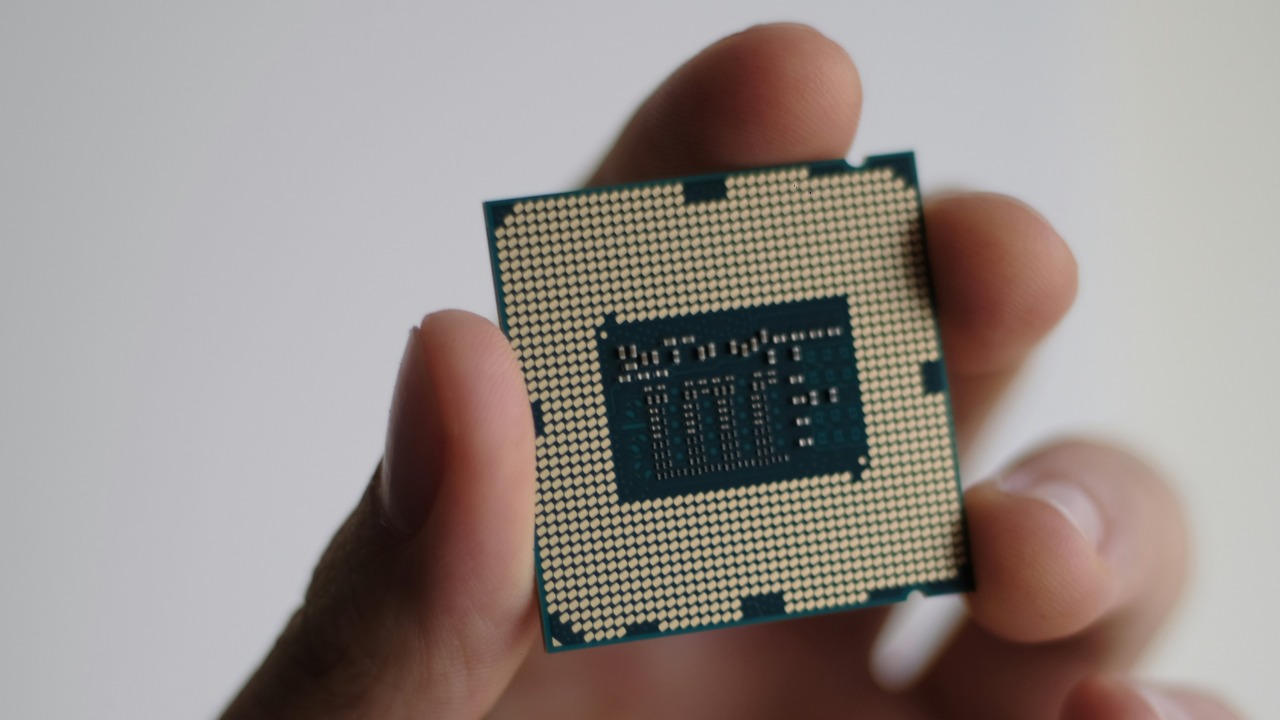

Explosive growth in AI applications, from large-scale data centers to advanced machine learning models, has sharply increased the need for specialized memory chips that can move and process data at high speed. Training and running systems such as generative AI models, recommendation engines, and real-time language translation tools require high-bandwidth memory that can keep pace with powerful accelerators, so each new deployment adds substantial pressure to already tight inventories. As cloud providers race to expand AI infrastructure, they are placing orders for memory at a scale that traditional consumer electronics markets never demanded.

According to reporting that describes how the AI frenzy is driving a memory chip supply crisis, this surge in AI-focused investment has outpaced the growth of smartphones, PCs, and other legacy devices that once set the rhythm for semiconductor production. Key metrics cited in industry briefings show memory chip orders doubling in recent quarters as hyperscale data center operators and major cloud platforms build out AI clusters at unprecedented speed. For chipmakers, the shift means that capacity planned around slower, more predictable consumer cycles is suddenly inadequate, and for AI firms, it translates into higher component prices, longer lead times, and tougher competition for every available high-bandwidth module.

Supply Chain Disruptions Unfold

The spike in demand is colliding with structural bottlenecks across the semiconductor supply chain, creating what one detailed account describes as a new global supply chain crisis driven by AI. High-bandwidth memory depends on advanced fabrication nodes, complex packaging, and a steady flow of ultra-pure materials, so any disruption at a single stage can ripple through the entire ecosystem. Constraints in equipment availability, limited capacity at cutting-edge foundries, and tight supplies of specialty chemicals and substrates are all slowing the ramp-up of new production lines just as AI customers are asking for more.

Delays in high-bandwidth memory production are hitting AI server manufacturers hardest, forcing some to postpone or scale back deployments that were meant to support new AI services. Regional dependencies on Asian foundries, which already dominate advanced memory and logic manufacturing, have amplified shortages compared with pre-2024 levels, because alternative sources in Europe or North America cannot yet match the same scale or technical capabilities. For governments and corporate buyers, the result is a renewed focus on supply chain resilience, as the risk that a single regional disruption could stall global AI rollouts becomes more visible and more costly.

Micron’s Strategic Investment Response

In response to these mounting pressures, Micron has announced a major expansion plan, with the company set to invest $9.6 billion in Japan to build a new AI-focused memory facility. Reporting on the move notes that Micron will invest $9.6 billion in Japan to construct an AI memory chip plant, marking a significant shift from its earlier emphasis on U.S.-centered growth. The decision reflects both the urgency of the current shortage and Japan’s strategic role in the semiconductor ecosystem, including its established base of materials suppliers, equipment makers, and skilled engineering talent.

The new facility is expected to target high-bandwidth memory production for AI accelerators, with internal projections indicating that it could boost global capacity by 20 percent within two years of coming online. Construction is slated to begin in 2025, a timeline that underscores how Micron is trying to alleviate current backlogs while also positioning itself for sustained AI-driven demand. For AI developers and data center operators, the project offers a potential medium-term relief valve, although the lag between investment and volume production means that tight supplies and elevated prices are likely to persist in the near term.

Global Stakeholder Impacts and Outlook

The supply crunch is already reshaping strategies at leading AI firms, including Nvidia and Google, which rely on high-bandwidth memory to power their accelerators and cloud platforms. As component costs rise and delivery schedules slip, these companies are pursuing diversified sourcing, closer partnerships with memory suppliers, and design optimizations that can extract more performance from each chip. The reporting that details how the AI frenzy is driving a memory chip supply crisis also highlights the broader economic stakes, with economies in China and other manufacturing hubs facing potential GDP drags if tech sector slowdowns spread to related industries such as electronics assembly, logistics, and industrial automation.

Looking ahead, policymakers and industry leaders are weighing a mix of incentives and regulatory changes aimed at expanding domestic chip production and reducing exposure to single-region risks. Proposals include subsidies for new fabrication plants, tax credits for advanced packaging facilities, and streamlined approvals for critical infrastructure projects, all intended to accelerate capacity growth without sacrificing quality or security. Even with these measures, experts cited in coverage of the AI-driven global supply chain crisis warn that volatility could persist until at least 2026, as the industry works through existing backlogs and calibrates new investments to a demand curve that is still evolving.