Asteroids are no longer just background scenery for planetary science, they are emerging as contested resource deposits that could reshape trillion‑dollar industries on Earth. The same rocks that once symbolized extinction risk now look like concentrated vaults of metals and volatiles, and the race is on to figure out who can turn that promise into profit first.

If the early internet rewarded those who built the pipes and platforms, the coming space economy is poised to reward those who secure and process off‑world resources. The path from raw asteroid to revenue is still experimental, but the outlines of a real business model are starting to come into focus.

Why some asteroids look like trillion‑dollar balance sheets

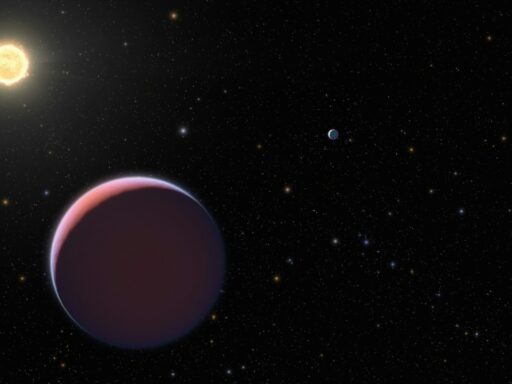

The economic case for asteroid mining starts with geology and scarcity. Scientists have identified near‑Earth objects that are unusually rich in platinum group metals, nickel, cobalt, and rare elements that are found only in certain places on our planet, and a single platinum‑rich rock a few hundred meters across has been valued in the trillions of dollars in potential market value. Reporting by Clarence Oxford describes how Scientists frame these bodies as concentrated ore deposits in space, not science fiction jackpots, because their composition can be inferred from spectral signatures and meteorite analogues.

Closer to home, experts categorize these targets into M‑type metallic bodies, C‑type carbonaceous rocks, and S‑type stony asteroids, each with a different resource profile and business case. Policy analysts note that the earliest commercial targets are likely to be near‑Earth objects, which are easier to reach and can be systematically identified and classified as M‑type, C‑type, and S‑type for specific mission designs, a taxonomy laid out in guidance on Called near‑Earth objects. In practical terms, metallic M‑type bodies look like future sources of high‑value metals, while carbonaceous C‑type rocks are attractive for water and volatiles that can be turned into propellant, life support, and construction feedstock in orbit.

The first movers: startups, spacecraft, and a new space race

The shift from theory to hardware is already underway as private companies design missions around specific asteroids with potential for mining. One California‑based venture has confirmed that it is preparing the first private mission to an Asteroid, with plans to test extraction techniques and eventually return tons of material to Earth, a milestone described in detail in coverage of a Space Mining Startup Confirms First Private Mission. That mission is less about flooding commodity markets and more about proving that small, relatively low‑cost spacecraft can rendezvous with a target, characterize its composition, and begin to manipulate its surface.

Alongside these newcomers, specialized firms are building the infrastructure that will make asteroid mining repeatable rather than heroic. At TransAstra, founder Joel Sercel has focused on technologies for capturing and processing small bodies, an approach that has drawn attention as private companies move into what used to be a purely national space race. In a feature by Hope Hodge Seck for Studio Gannett, When Joel Sercel describes how his team is targeting asteroids with potential for mining, he frames the effort as a logical extension of commercial launch and satellite services rather than a speculative side bet.

Market forecasts and the business models that might actually work

Investors are not waiting for the first ore shipment to start modeling returns. Allied Market Research has projected that the Asteroid Mining Market could reach 3,868.9 million dollars globally by 2025, with a 24.4 percent compound annual growth rate, and its breakdown of the sector by Phase and Space‑craft design highlights how much early revenue is expected to come from services rather than raw materials. In that forecast, the launch segment is expected to grow at a steady pace through 2025, while among asteroid types, the type M metallic bodies are singled out alongside type S and others as particularly important, and the 3D printing segment is described as capturing nearly the largest share among applications such as resource harvesting and others, all detailed in the Asteroid Mining Market analysis.

Those numbers hint at the real near‑term business model, which is less about shipping platinum to Los Angeles or Shanghai and more about selling in‑space services to governments and satellite operators. In a widely viewed presentation, one industry advocate bluntly states that for him it is actually not about astronomy, it is actually all about the money, because he is in the asteroid mining business to build a supply chain that can support other commercial activity in orbit, a perspective captured in the video titled Apr 12, 2022. In practice, that means monetizing prospecting data, leasing refueling depots, and licensing extraction hardware long before anyone tries to corner the global platinum market.

The legal frontier: who owns what in deep space

Even the most elegant business plan can stall if investors are not confident that they will own what they extract. Legal scholars point out that, Out of all of the countries involved in the exploration and discovery of outer space, only four have actively developed frameworks and legislation that address space resources, and they project that the global space economy could reach 1,000,000 million dollars by the year 2100 if those rules mature in a predictable way, according to a detailed analysis of Out of all of these countries. That gap between technological ambition and legal clarity is one of the biggest hidden risks in the asteroid mining story.

International law is still catching up to the idea that private entities might extract and sell resources from the Moon and other celestial bodies in the Solar system. Article 11 of the Moon Agreement states that the natural resources of the Moon and other celestial bodies in the Solar system are the common heritage of mankind, and it calls for an international regime to govern how states and private actors share the benefits they obtain from celestial bodies, as summarized in a review of Article 11 of the Moon Agreement. For companies planning to spend hundreds of millions of dollars on hardware, the unresolved tension between national licensing regimes and multilateral principles is not an abstract debate, it is a core part of the risk calculus.

The realistic path from rock to revenue

Turning asteroids into a profit center will not happen in a single leap from concept art to commodity markets, it will unfold in stages that mirror the early days of offshore drilling or deep‑sea mining. In the near term, the most valuable asteroids are likely to be those that can support other space activities, such as refueling satellites, supplying water for life support, or providing raw material for 3D printing structures in orbit, rather than those that promise a speculative windfall in precious metals. Analysts who argue that new policies are needed to advance space mining emphasize that these near‑Earth objects will be the earliest targets, precisely because they can be integrated into existing launch and satellite economics, a point underscored in the policy brief on Asteroids and new policies.

From there, I expect the path to profit to run through a sequence of increasingly ambitious steps: prospecting missions that sell data, demonstration projects that validate extraction and processing, in‑space manufacturing that uses asteroid‑derived feedstock, and only then large‑scale export of high‑value metals to Earth if the economics still make sense. The companies already building capture systems, such as the team at TransAstra led by Joel Sercel, and the California entrepreneurs planning the first private mission to an asteroid, are effectively laying the rails for that progression, even as market researchers like Allied Market Research and commentators like Hope Hodge Seck track how quickly investors and regulators adapt to the idea that these asteroids could indeed be worth a fortune.