South Korea is moving quickly to blunt the impact of new U.S. tariffs on advanced chips, signaling that it will push for preferential treatment as Washington tightens trade rules around artificial intelligence hardware. Officials in Seoul have framed the coming talks as a test of how far the two allies can align industrial policy without undermining each other’s strategic interests.

The presidential office has already made clear that it wants any new duties on memory and AI processors to reflect existing bilateral commitments, not unilateral pressure. I see this as a pivotal moment in the semiconductor power balance, with South Korea trying to lock in protections before the tariff regime hardens into a long term constraint.

Seoul’s push for favourable chip terms

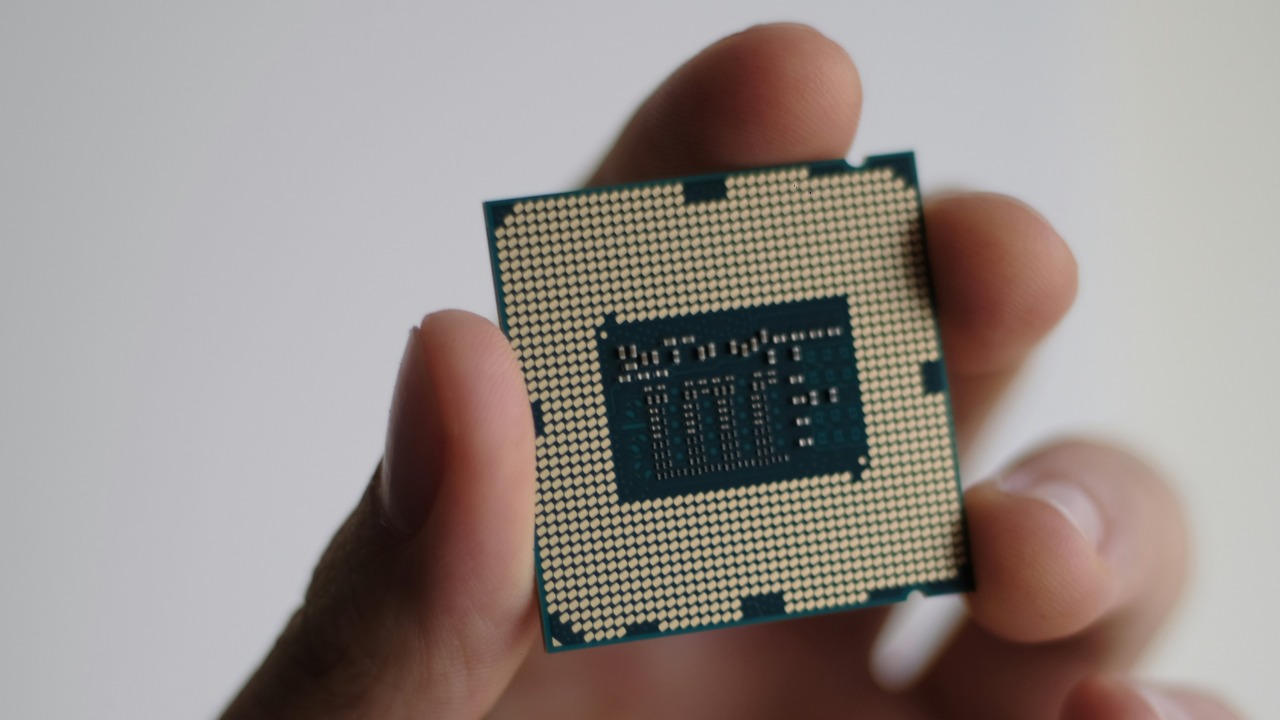

South Korea’s presidential office has publicly committed to seek better terms on U.S. tariffs for memory chips, framing the issue as a defense of national economic security rather than a narrow trade dispute. Officials have said that South Korea will favorable treatment on imports of memory chips into the American market, a critical outlet for Samsung Electronics and SK hynix. The message is that tariff design should not punish a close security partner that has built its economy around high end manufacturing.

At the same time, the Presidential Office has stressed that any new semiconductor tariffs must follow existing Korea U.S. agreement structures, signaling that Seoul expects Washington to honor “no less favorable” clauses embedded in prior deals. By tying the tariff debate to already signed agreements, the government is trying to shift the conversation from discretionary punishment to treaty compliance, which gives it more leverage in any negotiation with the United States.

Parity with Taiwan and the ‘no less favorable’ clause

Seoul’s immediate benchmark is not just lower tariffs in the abstract but parity with Taiwan, which has become the reference point for how Washington treats key chip suppliers. Officials have indicated that Seoul will press treatment that matches what Taiwanese manufacturers receive under U.S. AI chip tariffs, especially for products destined for data centers and public sector use. The argument is straightforward: if both economies are indispensable to the same supply chains, they should not face structurally different barriers at the U.S. border.

To reinforce that case, the government has explicitly invoked a “no less favorable” commitment in its trade arrangements, a phrase that surfaced in a statement from Seoul earlier in Jan. According to that statement, cited By Jie Ye, the administration wants tariff treatment that is no less favorable than that granted to Taiwan or other partner countries, and it is prepared to make that a central plank of its diplomatic outreach. The reference to Jan and to Taiwan is not rhetorical; it is a legal framing that positions South Korea as an equal, not a junior, player in the semiconductor hierarchy.

U.S. pressure, 100% tariff threats and investment demands

Washington is not approaching this as a one sided concession, and the pressure on Korean firms has been explicit. Commerce Secretary Howard Lutnick has warned that some South Korean and chipmakers could face tariffs of up to 100% on certain products unless they expand manufacturing inside the United States. That 100% figure is not just a negotiating bluff; it is a clear signal that access to the American market will increasingly be conditioned on local investment, which aligns with President Donald Trump’s broader industrial policy.

Separate reporting has described how the U.S. government Pressures South Korea to Match Taiwan in terms of Semiconductor Investment, effectively asking Korean champions to mirror the scale of Taiwanese commitments in exchange for tariff exemption quotas. I read this as Washington trying to orchestrate a race to build fabs on U.S. soil, using the threat of punitive duties as leverage. For Seoul, the challenge is to convert that pressure into predictable, rules based access rather than a rolling series of ad hoc demands.

Limited short term impact, but rising long term risk

South Korea’s trade ministry has tried to calm markets by arguing that the immediate fallout from the new U.S. measures will be contained. In comments carried by Reuters, officials said the first wave of tariffs on AI chips would have limited short term impact because they target a narrow set of products, including specific AI processors such as Nvidia’s NVDA branded accelerators and AMD’s MI325X. That assessment rests on the fact that Korean firms are still ramping up their own AI specific offerings, so the earliest duties bite more directly on U.S. chip designers than on Korean memory producers.

Yet the same analysis acknowledges that the risk profile changes sharply if the tariff net widens to cover a broader range of memory and logic components. The presidential office’s focus on Semiconductor Tariffs and their alignment with existing agreements reflects a fear that what is now a targeted AI policy could evolve into a more sweeping industrial barrier. From my perspective, the ministry’s reassurance about the present is really a warning about the future: if Seoul does not lock in favorable terms now, it may find itself negotiating from a weaker position once more product lines are on the table.

Domestic policy tools and the role of MOTIE

Behind the scenes, South Korea is also adjusting its own regulatory posture to show that it can be a reliable and sophisticated partner in managing sensitive trade flows. The MOTIE, formally The MOTIE or Ministry of Trade, Industry and Energy, has tightened export control measures on Russia, Belarus and North Korea while reinstating Japan to South Korea’s trade whitelist through an amended Public Notice on the Trade of Strategic Ite. That move signals to Washington that Seoul is willing to shoulder more responsibility in policing high tech exports, which strengthens its case for trust based tariff arrangements on semiconductors.

The same ministry has been active in other regulatory areas, issuing Ministry of Trade, 442 as an amendment to the Regulation on Energy Efficiency Labelling and Standards. While that notice is not directly about chips, it illustrates how the South Korean Ministry of Trade, Industry, Energy and MOTIE are using detailed rulemaking to align domestic standards with global expectations. In negotiations with the United States, that technocratic credibility matters, because it allows Seoul to argue that it can manage complex supply chain risks without the blunt instrument of tariffs.

Supporting sources: Seoul seeks favourable.