US technology shares fell sharply as investors questioned whether the recent AI-driven rally in US tech stocks had gone too far, triggering a broad slide across major Silicon Valley names. The pullback in high-flying AI beneficiaries reignited worries that expectations for artificial intelligence revenues and profits may be overheating, prompting a reassessment of valuations across the sector.

Market reaction to renewed AI jitters

US tech stocks led the broader market lower as traders rotated out of high-growth names tied to artificial intelligence, reversing a powerful run-up that had dominated major indices for months. The latest bout of selling followed a period in which gains in US technology shares were propelled by optimism that AI-related earnings would scale rapidly, lifting everything from chipmakers to cloud platforms. As that optimism cooled, benchmark indices that are heavily weighted toward Silicon Valley groups, including the Nasdaq-style growth universe and tech-heavy slices of the S&P 500, came under pressure, signalling that investors were no longer willing to pay peak multiples for the most speculative AI stories.

The sell-off concentrated in companies most closely associated with the AI boom, underscoring how sensitive the sector has become to even modest shifts in sentiment about future AI demand. Traders who had previously chased momentum in AI-linked leaders moved to lock in profits, while systematic and options-driven strategies amplified intraday swings as prices broke through recent support levels. The reversal from earlier gains in US technology shares that had been propelled by optimism over AI-related earnings highlighted how quickly enthusiasm can flip to caution when valuations are built on aggressive assumptions about technologies that are still being commercialised at scale.

Reassessment of AI valuations and earnings expectations

As prices fell, investors began to question whether valuations for leading AI-focused tech companies accurately reflect the timing and scale of potential AI revenues. The earlier AI-driven rally in US tech stocks had pushed price-to-earnings and price-to-sales ratios for some high-profile names to levels that implied near-frictionless adoption of generative AI tools across industries, from enterprise software to digital advertising. With the latest pullback, portfolio managers and analysts started to revisit discounted cash flow models, stress-testing scenarios in which AI monetisation arrives more slowly, customer budgets prove more constrained, or regulatory scrutiny raises compliance costs for large-scale data and model deployments.

Concerns also grew that the pace of the AI boom may not match the aggressive earnings forecasts currently embedded in share prices, particularly for companies that have yet to demonstrate durable, recurring AI revenue streams. The pullback has prompted analysts to scrutinise assumptions around capital spending, monetisation, and profitability for US tech groups betting heavily on AI, including the cost of building and operating advanced data centres, the economics of AI-as-a-service pricing, and the margin impact of bundling AI features into existing products at little or no incremental charge. For investors, the stakes are significant, because any reset in expectations for AI-related earnings could ripple across the broader growth complex, affecting everything from venture-backed start-ups to the largest listed platforms that anchor retirement portfolios and index funds.

Impact on major Silicon Valley players and sector leadership

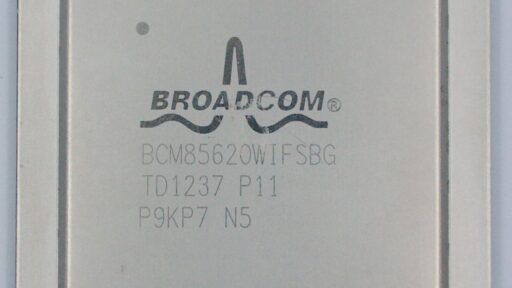

The slide hit large-cap US technology companies hardest where valuations had become most closely tied to AI growth narratives, putting pressure on the Silicon Valley names that had previously led the market higher. Companies that supply AI infrastructure, such as advanced semiconductors, networking hardware, and hyperscale cloud capacity, saw some of the sharpest moves as traders reassessed how sustainable recent order trends might be. Software and internet platforms that had highlighted AI as a key driver of future engagement and advertising efficiency also faced selling, reflecting doubts about how quickly those promises will translate into measurable revenue and profit uplift.

As these AI-linked leaders stumbled, their weight in major indices meant the slide in US tech stocks dragged on broader benchmarks that are heavily exposed to the sector. The shift prompted a temporary change in sector leadership, with investors favouring less AI-dependent parts of the US equity market, including more defensive industries such as utilities, consumer staples, and certain healthcare names. That rotation matters for asset allocators who had leaned heavily into growth and technology during the AI-driven upswing, since even a modest rebalancing toward value or income-oriented sectors can alter performance rankings, factor exposures, and risk profiles across multi-asset portfolios.

Investor sentiment, risk appetite, and volatility

Renewed fears over the AI boom had a visible impact on risk appetite, as some investors chose to lock in profits after a strong run-up in tech and re-evaluate how much AI exposure they were comfortable holding. The earlier rally had drawn in a wide spectrum of buyers, from long-only mutual funds and pension plans to hedge funds and retail traders using options to amplify bets on AI winners. When sentiment turned, that crowded positioning left the market vulnerable to sharp reversals, with profit-taking in the most extended names spilling over into related segments such as high-growth software, digital media, and smaller-cap hardware suppliers that had been pulled higher by association.

Volatility indicators tied to US tech shares picked up as traders repositioned around AI exposure, reflecting both hedging activity and speculative attempts to trade the swings. Options markets saw increased demand for downside protection in key AI-linked stocks, while intraday price ranges widened as liquidity providers adjusted to faster order flow and shifting risk parameters. For portfolio managers, the move forced a fresh look at how concentrated their returns had become in a narrow group of AI beneficiaries, encouraging some to rebalance between growth and more defensive sectors in response to the slide in AI-related tech stocks that had previously dominated performance tables. The adjustment underscores how quickly a thematic trade can morph into a broader risk-management challenge when volatility rises and correlations across tech subsectors tighten.

What the pullback signals about the next phase of the AI trade

The latest drop in US tech stocks tied to AI is being interpreted by many market participants as a necessary, if uncomfortable, correction after a powerful speculative phase, rather than an outright repudiation of the technology’s long-term potential. The earlier surge in valuations had been fuelled by a belief that AI would rapidly transform productivity and profit margins across the economy, lifting the earnings power of companies that could supply the required chips, cloud capacity, and software tools. By contrast, the current pullback is forcing a more granular assessment of which business models can convert AI enthusiasm into sustainable cash flows, and on what timeline, a shift that could ultimately support a healthier, more discriminating market for AI exposure.

The episode is also likely to sharpen the distinction between companies with tangible near-term AI revenues and those riding the AI boom narrative without clear business models or visibility on monetisation. Investors are increasingly looking for evidence of concrete customer adoption, such as signed contracts for AI infrastructure, measurable uplift in subscription pricing tied to AI features, or documented efficiency gains that justify higher software spending. Future earnings reports and AI deployment milestones will be critical in either validating or undermining the lofty expectations that had powered the earlier AI-driven tech rally, with particular attention on whether management teams can back up their guidance with detailed metrics on usage, unit economics, and return on investment. For now, the pullback in US technology shares, as highlighted in reporting on how US tech stocks slide as fears over AI boom flare up, signals that the market has entered a more demanding phase in which AI stories must be supported by hard data rather than aspirational forecasts.