SoftBank and Nvidia are looking to invest in Skild AI at a $14 billion valuation, according to people familiar with the matter, in what would be one of the largest funding pushes yet into AI infrastructure by established tech and investment giants. The potential deal highlights how quickly valuations for promising AI startups are climbing as investors race to secure stakes in companies that can underpin the next generation of artificial intelligence services.

Skild AI’s Background

Skild AI has emerged as a target startup focused on AI technologies at a moment when demand for large-scale computing and model development is reshaping the competitive landscape. People briefed on the talks say the company is being positioned as a core infrastructure player, building advanced AI solutions that can support both training and deployment of complex models for enterprise and consumer applications. That focus on foundational capabilities, rather than a single end-user product, is a key reason investors are prepared to discuss a valuation at the $14 billion level, since it suggests Skild AI could become a critical supplier to a wide range of AI developers.

Although detailed financials have not been disclosed, the interest from major backers indicates that Skild AI has already cleared several milestones that typically precede a multibillion-dollar valuation, including earlier funding rounds and technical benchmarks that attracted attention from strategic partners. Sources involved in the process describe a company that has moved quickly from early-stage experimentation into building scalable infrastructure, a trajectory that aligns with the broader shift in AI investing from small research teams to platforms that can serve global demand. For founders and early employees, a valuation of $14 billion would crystallize Skild AI’s status as a top-tier AI infrastructure contender and set expectations for rapid expansion in headcount, data center capacity and customer reach.

SoftBank’s Investment Strategy

SoftBank has a long history of backing high-growth technology firms, and its pursuit of Skild AI at the $14 billion mark fits squarely within that playbook. People familiar with the matter say the group is in active negotiations to participate in a new funding round that would value the company at that level, a move that would extend SoftBank’s aggressive push into artificial intelligence after earlier bets on chip designers, robotics and automation platforms. By targeting Skild AI, SoftBank is signaling that it wants exposure not only to AI applications but also to the infrastructure layer that will determine which companies can scale models efficiently and profitably.

According to reporting on the talks, SoftBank is exploring a significant capital commitment as part of the potential round, with discussions described as time sensitive as the parties work through valuation and governance terms linked to the $14 billion figure. One account of the negotiations notes that SoftBank is weighing how a stake in Skild AI could complement its broader AI portfolio, including previous investments in companies that rely heavily on high-performance computing capacity, and that calculus is shaping the size and structure of its proposed participation. For existing shareholders and employees, SoftBank’s involvement would likely bring both capital and a powerful distribution network, while for rival investors it underscores how quickly competition is intensifying for ownership in the most promising AI infrastructure startups.

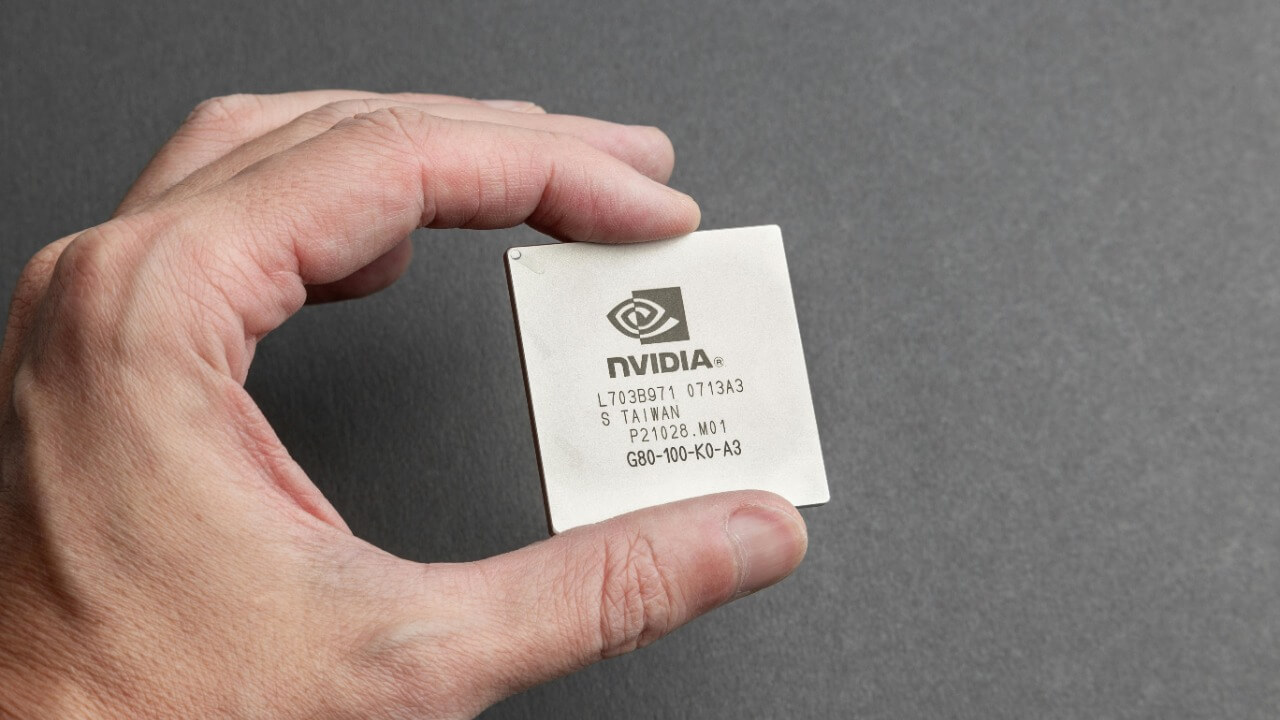

Nvidia’s Role in the Deal

Nvidia, which dominates the market for graphics processing units used to train and run large AI models, is also looking to invest in Skild AI alongside SoftBank, according to people cited in an exclusive report on the potential funding round. The company’s strategic interest centers on deepening the link between its hardware and the software and infrastructure layers that customers rely on to deploy AI at scale, and a stake in Skild AI would give Nvidia closer insight into how large customers are architecting their systems. By participating in the talks that value Skild AI at $14 billion, Nvidia is effectively endorsing the startup’s technology stack as a promising complement to its own chips and networking products.

People briefed on the discussions say Nvidia’s involvement is seen as a potential accelerator for Skild AI’s development, since closer alignment with the leading supplier of AI accelerators could translate into earlier access to new hardware, joint optimization work and co-marketing opportunities. That kind of ecosystem partnership would mark a shift from earlier periods when infrastructure startups often operated more independently from chip vendors, and it could give Skild AI an edge over rivals that lack similar strategic backing. For Nvidia, the investment would help lock in demand for its processors and software tools at a time when cloud providers and large enterprises are weighing how to balance their reliance on a few dominant chipmakers with the need for flexible, multi-vendor architectures.

Implications for the AI Sector

The prospect of a $14 billion valuation for Skild AI is already being read by investors and founders as a new benchmark for AI infrastructure startups, according to people familiar with market reactions cited in a detailed account of the talks on SoftBank and Nvidia’s investment plans. Valuations at this scale have typically been reserved for companies with substantial revenue or user bases, yet the willingness of major backers to discuss such a figure for Skild AI reflects expectations that demand for training and inference capacity will continue to grow rapidly. For other AI startups, the deal would raise the bar for what constitutes a top-tier infrastructure play, potentially concentrating capital in a smaller number of platforms that can credibly promise global scale.

Stakeholders across the AI ecosystem are watching the negotiations closely, since SoftBank and Nvidia’s entry would alter the competitive dynamics around Skild AI and its peers. Customers evaluating long-term infrastructure partners may see a company backed by both a deep-pocketed investment group and a leading chip supplier as a safer bet, which could steer workloads and contracts toward Skild AI at the expense of smaller rivals. People familiar with the talks say the parties are working toward a potential agreement that could be finalized in the near term, although the exact timing of any deal closure remains subject to ongoing negotiations, and that uncertainty is prompting other investors to reassess how quickly they move on comparable opportunities. For the broader AI sector, the outcome will help define how capital, strategic partnerships and technical roadmaps intersect as the industry races to build the infrastructure that will power the next wave of artificial intelligence applications.