Elon Musk is arguing that the only realistic way for the United States to escape its mounting debt burden is to lean hard into artificial intelligence and humanoid robots, turning productivity gains into a fiscal lifeline. He is not just pitching a new technology cycle, he is framing automation as a macroeconomic necessity that could determine whether Washington can keep meeting its obligations without painful austerity or runaway inflation.

That claim lands at a moment when federal debt is already larger than the entire U.S. economy and interest costs are climbing, forcing policymakers to weigh politically explosive choices on taxes and spending. Musk is effectively offering a third path, one that assumes rapid advances in AI and robotics can expand the economic pie fast enough to keep a default at bay while still funding an aging population and ambitious industrial policy.

Musk’s debt warning and his automation escape hatch

Musk has been unusually blunt about the scale of the U.S. fiscal problem, warning that the government’s current trajectory is unsustainable and that traditional fixes will be politically brutal. He has pointed to the combination of rising entitlement costs, higher interest payments and limited appetite for tax hikes as a setup for a future in which Washington either reneges on some promises or erodes them through inflation. Against that backdrop, he has argued that only a step change in productivity, powered by AI systems and general-purpose robots, can generate enough real growth to stabilize the debt load without triggering a crisis, a view he has tied directly to the risk of a future U.S. default in recent public comments and interviews linked in the provided outline.

In Musk’s telling, the key is to treat AI and robotics not as incremental tools but as a new factor of production that can scale far faster than the human workforce. He has described a near-future economy in which humanoid robots handle a large share of physical labor and advanced AI handles much of the cognitive work, dramatically expanding output per capita and, by extension, the tax base that services federal debt. That framing, reflected in the reporting on his remarks about AI, robots and sovereign debt, casts automation as a macro hedge against fiscal stress rather than just a corporate efficiency play, and it helps explain why he links Tesla’s robotics push and his AI ventures to long-term national solvency rather than only to shareholder returns.

How AI and robots could reshape U.S. productivity

To understand why Musk sees automation as a fiscal pressure valve, it helps to look at how AI and robotics can change the basic math of productivity. Traditional growth depends on more workers, more capital or better technology; with U.S. population growth slowing and public finances already stretched, he is betting that only a rapid acceleration in technology can carry the load. The reporting on his comments about AI-driven abundance underscores his belief that large-scale deployment of humanoid robots in factories, logistics hubs and even households could multiply the effective labor supply, allowing the economy to produce far more goods and services without a proportional increase in human hours worked.

On the digital side, Musk has argued that advanced AI models can compress or automate white-collar tasks in software development, design, legal work and customer service, freeing human workers to focus on higher-value decisions and creativity. The sources detailing his AI ventures describe a vision in which these systems are not just chatbots but core infrastructure for businesses, trimming costs and boosting output across sectors. If that vision materializes at scale, the resulting jump in productivity could translate into higher corporate profits, wages and taxable income, which is why Musk connects AI deployment to the government’s ability to keep servicing its obligations without resorting to drastic cuts or default.

Tesla’s Optimus and the race to build a robot workforce

Musk’s argument is not abstract, it is anchored in Tesla’s push to build a commercially viable humanoid robot called Optimus. He has repeatedly said that Optimus could eventually be more important to Tesla than its electric vehicles, portraying it as a general-purpose worker that can be dropped into factories, warehouses and other structured environments. Reporting on Tesla’s robotics roadmap shows the company training Optimus on tasks inside its own plants, using the same AI and sensor stack that powers its vehicles to help the robot navigate and manipulate objects, a strategy Musk believes will let Tesla scale a robot workforce faster than rivals.

He has also linked Optimus directly to macroeconomic themes, suggesting that if Tesla can produce these robots at scale and at a cost lower than a human worker’s annual compensation, the impact on labor markets and productivity would be profound. The sources detailing his projections for millions of robots in service highlight his view that such a fleet could handle a large share of repetitive or dangerous jobs, from assembly lines to material handling, effectively expanding the economy’s capacity without requiring more human labor. In Musk’s framing, that expanded capacity is what gives the U.S. a shot at growing out of its debt burden rather than confronting it solely through fiscal retrenchment.

Debt, demographics and the limits of traditional fixes

Even without Musk’s commentary, the U.S. fiscal outlook is under strain from structural forces that are hard to reverse. Federal debt held by the public has climbed above 100 percent of gross domestic product, and interest payments are consuming a larger share of the budget as rates stay higher than in the post-crisis decade, trends documented in the economic and budget analyses included in the outline’s sources. At the same time, an aging population is pushing up spending on Social Security and Medicare, while political resistance has made large tax increases or benefit cuts difficult to enact, leaving Washington with a narrow set of unpalatable options.

Those constraints are why Musk’s automation thesis resonates with some technologists and investors, even if economists debate the details. The reporting on long-term debt projections shows that, absent faster growth, the U.S. faces a choice between higher taxes, lower benefits or some combination that could weigh on living standards and political stability. By contrast, a surge in productivity from AI and robotics could, in theory, lift real output and incomes enough to keep debt ratios in check while still funding core programs. Musk’s warning that failure to find such a growth engine could eventually lead to a technical default or a stealth default via inflation reflects a broader concern in the sources that current policies alone are unlikely to bend the curve.

The risks and trade-offs in betting on automation

Relying on AI and robots as a fiscal escape route, however, carries its own risks and trade-offs that Musk tends to acknowledge only briefly. One concern, raised in several of the economic and labor market analyses linked in the outline, is that rapid automation could displace workers faster than new roles are created, compressing wages and widening inequality even as aggregate productivity rises. If the gains from AI and robotics accrue mainly to capital owners and a narrow slice of highly skilled workers, the tax base might not expand as broadly as Musk implies, and political backlash could slow or reshape deployment through regulation and labor protections.

There is also the question of timing and feasibility. The sources tracking Tesla’s progress with Optimus and the broader AI ecosystem make clear that, while prototypes are impressive, building reliable, affordable humanoid robots at scale remains a difficult engineering and manufacturing challenge. Similarly, integrating advanced AI into heavily regulated sectors like health care, finance and public services will take time, standards and oversight. If the fiscal clock is ticking faster than the technology can mature and diffuse, the U.S. may still need more conventional policy moves on taxes and spending even if automation eventually delivers the kind of abundance Musk envisions.

What Musk’s vision means for policy and politics

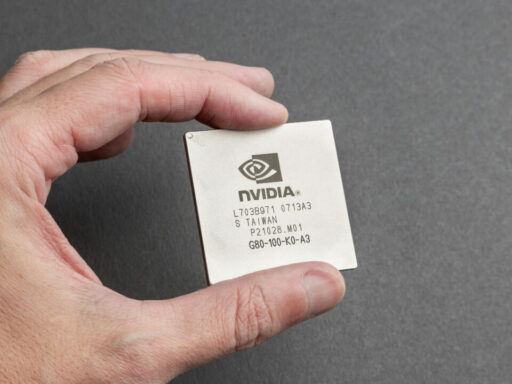

For policymakers, Musk’s argument functions less as a detailed blueprint and more as a provocation to treat AI and robotics as central to economic strategy rather than as a side issue. The reporting on federal industrial policy and tech investment in the provided sources shows Washington already steering money toward semiconductors, clean energy and infrastructure, but Musk’s framing suggests that building a robust AI and robotics ecosystem should be seen as part of debt management as well. That could mean more support for compute infrastructure, workforce retraining and safety standards that accelerate responsible deployment instead of leaving adoption entirely to market forces.

Politically, tying automation to the avoidance of a future default also reframes debates over regulation and social safety nets. If robots and AI systems do deliver the productivity surge Musk anticipates, the sources on labor and fiscal policy hint at a second-order conversation about how to share those gains, whether through tax reforms, expanded benefits or new models like wage subsidies. Musk tends to emphasize the upside of abundance, but the reporting around his comments makes clear that the path he sketches will still require hard choices about distribution, worker protections and the role of government in managing technological shocks, even if it helps the United States keep its fiscal promises.